Cup And Saucer Technical Analysis

Its the final consolidation before breaking out. Spotting technical analysis patterns can be daunting especially at first.

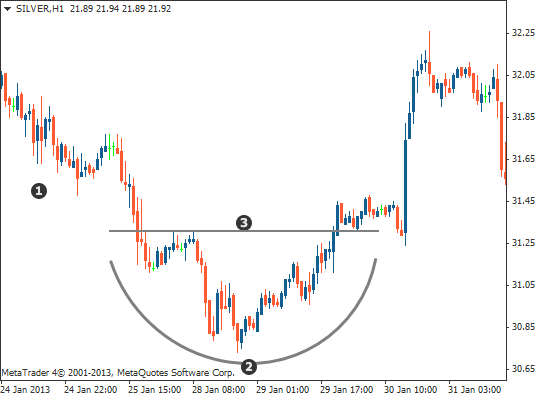

Rounded Top And Bottom Chart Pattern Tradimo

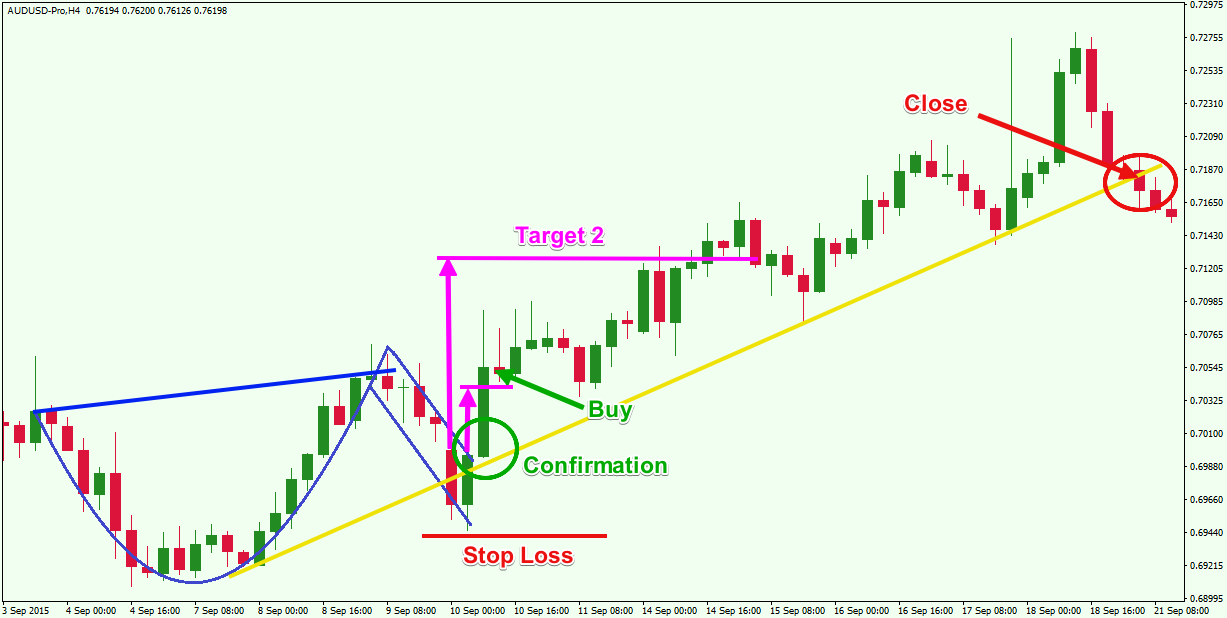

The cup and handle is a bullish continuation pattern.

Cup and saucer technical analysis. Cup and handle pattern of technical analysis the cup and handle formation also called the cup with handle formation is a bullish chart pattern that is defined by a chart where a stock drops in value then rises back up to the original value then drops a small amount in value and then rises a small amount in value. Once the pattern is complete the stock should continue to trade upward in the. A cup and handle chart may signal either a reversal pattern or a continuation pattern.

Study technical analysis patterns. A cup and handle price pattern on bar charts is a technical indicator that resembles a cup and handle where the cup is in the shape of a u and the handle has a slight downward drift. The handle is formed when a trading range happens.

The cup with handle is a bullish continuation pattern that marks a consolidation period followed by a breakout. A rounding top is a chart pattern used in technical analysis which is identified by price movements that when graphed form the shape of an upside down u. A saucer also called rounding bottom refers to a technical charting pattern that signals a potential reversal in a securitys price.

A reversal pattern occurs when the price is in a long term downtrend then forms a cup and handle that reverses the trend and the price starts rising. Without volume the pattern breaks down. The price is rising forms a cup and handle and then continues rising.

A saucer top is considered a bearish signal indicating a possible reversal of the current uptrend to a new downtrend. Chartschool chart analysis chart patterns cup with handle. Volume is needed to cause the breakout.

It was developed by william oneil and introduced in his 1988 book how to make money in stocks. It is marked by a consolidation followed by a breakout. Saucers or rounded tops and bottoms are another form of reversal pattern that is used in long term technical analysis.

The right hand side of the pattern typically has low trading volume and may be as short as seven weeks or as long as 65 weeks. The cup forms a u shaped pattern. A continuation pattern occurs during an uptrend.

Saucer Bottom Cup And Handle And Spikes

Text Sign Showing Data Management Analysis Tools Conceptual Photo

7 02 Cup With Handle Personal Finance Lab

Inverted Cup And Handle Pattern A Bearish Technical Trading

The Three Most Common Chart Patterns Page 1 Stock News Stock

Icici Technical Chart Cups And Saucer Pattern Bramesh S

Chart Your Way To Profits The Online Trader S Guide To Technical

Trading The Cup And Handle Chart Pattern For Maximum Profit

What Is A Cup And Saucer In A Stock Chart Quora